DATE PUBLISHED: August 28, 2024

Australian Corporates Lag U.S., European Peers in Climate Disclosure

Introduction

With the update of Australia’s Sustainable Finance Roadmap in June 2024, Australian corporates are facing tough new rules on climate disclosures as the country aligns itself more closely with global standards related to climate and sustainability goals. The Roadmap introduces key reforms for listed companies, focusing on improving transparency, enhancing financial system capabilities, and strengthening government engagement. Since the initial release of the Roadmap in November 2020, the Australian government has only gradually stepped up efforts to position itself as a leader for sustainable finance in the Asia-Pacific region. ISS-Corporate research found that less than half of the companies in the ASX 300 index are currently aligned with the main global standard for climate disclosures, lagging significantly behind U.S. and European peers. This cautious approach is primarily driven by the dependence of the Australian economy on high emitting industries, such as energy, metals, and mining. The introduction of climate-related disclosures, aligned with Task Force on Climate Related Financial Disclosures (TCFD) recommendations and, moving forward, with the International Financial Reporting Standards (IFRS) S2, marks a significant step towards standardized and globally comparable climate risk reporting.

Key Highlights

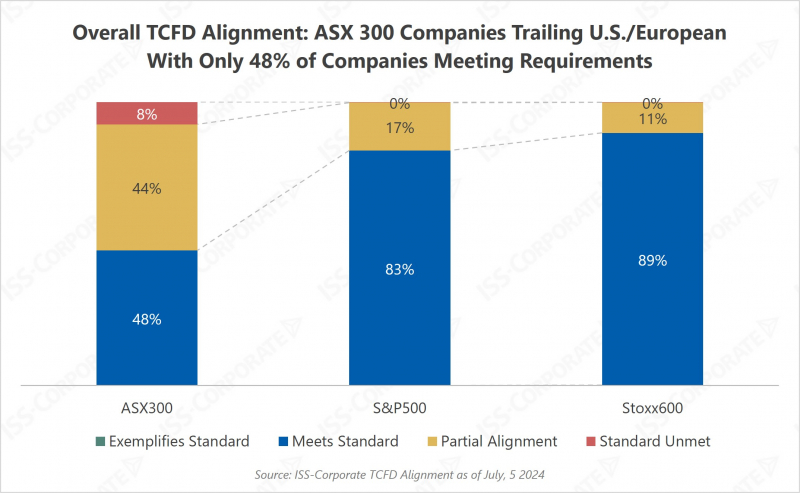

- Climate Disclosures: Approximately 48% of Australian companies (ASX 300) meet TCFD disclosure requirements, lagging comparable indices in the U.S. (S&P 500) and Europe (STOXX Europe 600) peers at 83% and 89% respectively.

- Scope 3 GHG Emissions Disclosures: Australia’s issuers trail European and U.S. companies in Scope 3 emissions disclosures. However, the Utilities, Consumer Staples, and Industrials sectors in Australia demonstrate leading practices for some of the most relevant Scope 3 categories, including “Category 5 – Waste Generated in Operations” and “Category 4 – Upstream Transportation and Distribution.”

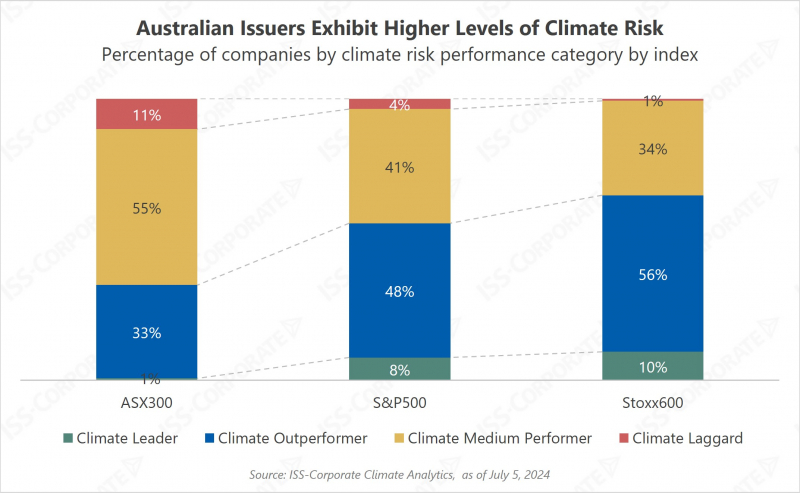

- Climate Performance: Two-thirds of Australian companies under review have average or below-average climate performance, lagging their respective European and U.S. industry peers by 31 and 21 percentage points, respectively.

Mandatory Climate-Related Disclosures

Australia’s Sustainable Finance Roadmap introduces mandatory climate-related financial disclosures for large businesses and financial institutions, aligning with global trends. Commencement dates for first reports are set for financial years beginning on or after Jan. 1, 2025, and are underpinned by standards developed by the Australian Accounting Standards Board (AASB), adhering to IFRS S1 and S2.

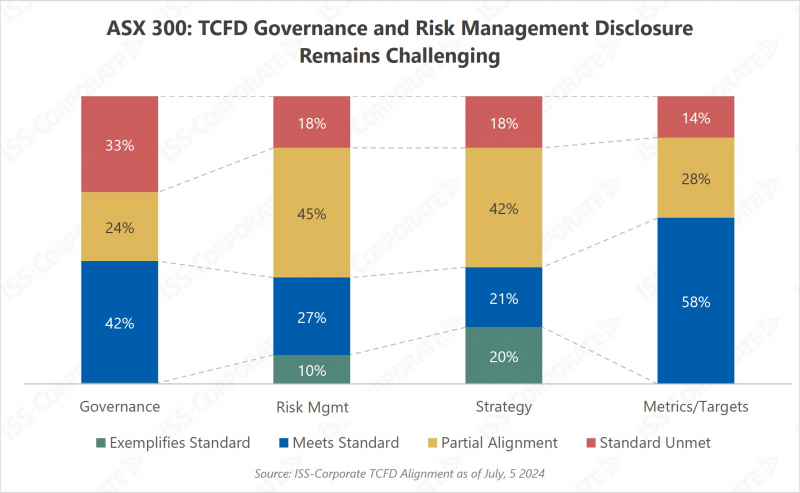

Current TCFD alignment for ASX 300 companies stands at 48%, significantly lower than the level of alignment among companies in the S&P 500 (83%) and Stoxx 600 (89%) indices. Major gaps exist in “Risk Management” and “Strategy” disclosures, with 63% and 60% of ASX 300 companies not meeting or only partially meeting TCFD requirements in these two areas, respectively. Notably, no company demonstrates exemplary standards in the pillars of “Governance” and “Metrics & Targets.” This indicates that even financial institutions and high-emitting sectors, which tend to be leaders in climate disclosures in other regions, have substantial room for improvement to meet the upcoming regulatory requirements.

The adoption of IFRS S2 leads to a further significant enhancement in transparency requirements for listed companies. Issuers will need to provide investors with more detailed information about their exposures to climate-related financial risks and opportunities, as well as their climate-related plans and strategies.

As ISS-Corporate highlighted in our past report – Mapping TCFD to the IFRS S2 on Climate Disclosures: “IFRS S2 is structured on the same four reporting pillars as TCFD: Governance, Strategy, Risk Management and Metrics & Targets. However, more than 50% of the (roughly 100) IFRS S2 cross-industry disclosure requirements are additional to TCFD, and another 26% are substantial advancements to the TCFD recommendations. Most of the new requirements are linked to information about Strategy and granular disclosure of climate Metrics & Targets.”

Scope 3 GHG Emissions Disclosures

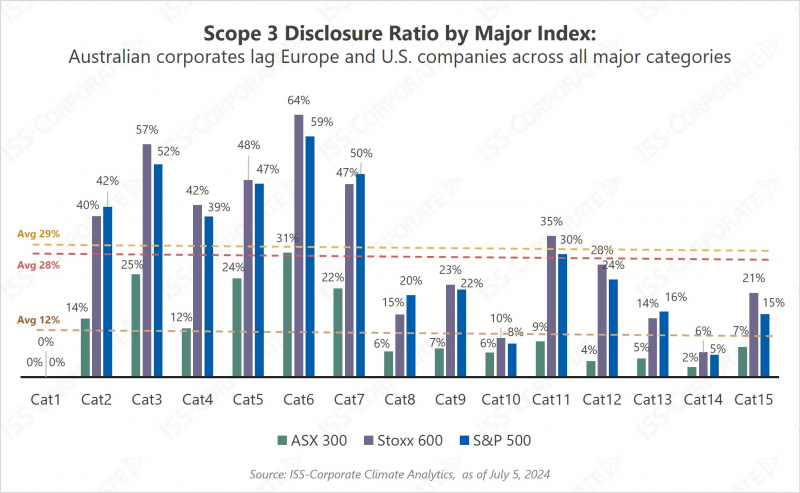

To further evaluate the disclosure readiness of ASX 300 companies, ISS-Corporate analyzed the disclosures of Scope 3 by category. Across all industries, Australian issuers lag European and U.S. peers, with an average disclosure rate of 12% across all categories, trailing the Stoxx 600 by 17 percentage points and the S&P 500 by 16 percentage points.

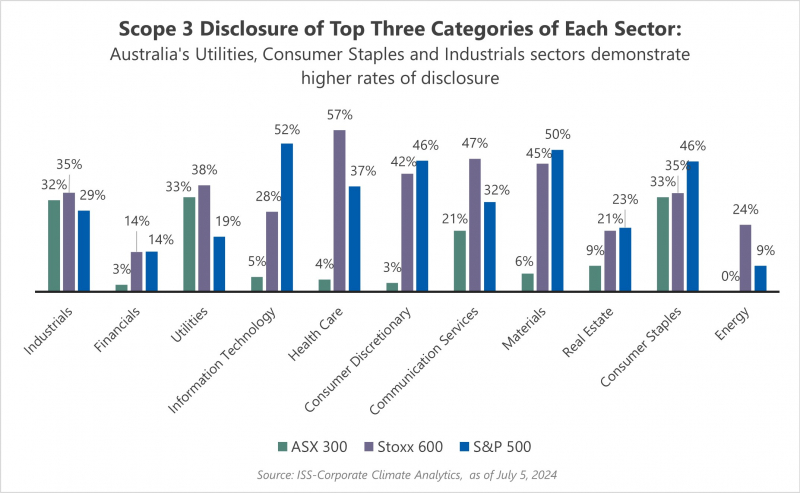

Scope 3 disclosures can vary significantly by industry, as companies tend to disclose only the categories most relevant to their product impacts or upstream and downstream operations. For example, one of the most relevant categories for the Energy sector is “Category 11 – Use of sold products,” including emissions from the use of fuel. “Category 15 – Investments” is more relevant to the Financials sector, as it accounts for financed emissions. ISS-Corporate analyzed the ratio of companies disclosing the top three categories within their sector based on the highest disclosure rate within each sector, excluding “Category 6 – Business travel” and “Category 7 – Employee commuting.” The analysis shows that the maturity of climate disclosures varies significantly among sectors. Australian corporations in the Consumer Staples, Utilities, and Industrials sectors show disclosure rates similar to their European and U.S. peers. Other industries like Healthcare, Energy, Financials, and Consumer Discretionary demonstrate noteworthy gaps in Scope 3 emissions disclosure.

Climate Performance

The gaps in climate disclosure also translate into lower climate performance. For a review of climate performance, we leveraged ISS-ESG’s Carbon Risk Rating methodology[1]. The rating provides a forward-looking metric to evaluate how far a company is exposed to climate/carbon risks and opportunities, and whether these are managed effectively. Higher carbon risk levels among Australian corporations may translate into a greater need for investments and capital expenditures to decarbonize operations. Among ASX 300 companies, only 34% are considered “climate outperformers” or “climate leaders” per the methodology criteria. That is 22 percentage points lower compared to corporates in the S&P 500 and 32 percentage points lower than the companies in the STOXX Europe 600.

Key Action Points: Preparing for the New Regulatory Landscape

As Australia’s sustainable finance reforms take shape, listed companies must proactively adapt to the evolving regulatory environment. This preparation is crucial not only for compliance but also for capitalizing on emerging opportunities in the green economy. Companies may consider some of the following steps, as they develop their climate disclosures and decarbonization strategies:

As Australia’s sustainable finance reforms take shape, listed companies must proactively adapt to the evolving regulatory environment. This preparation is crucial not only for compliance but also for capitalizing on emerging opportunities in the green economy. Companies may consider some of the following steps, as they develop their climate disclosures and decarbonization strategies:

- Conduct a comprehensive gap analysis of the current disclosures against the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. This exercise will provide a clear roadmap for aligning with the forthcoming mandatory reporting requirements.

- Identify and prioritize Scope 3 category measurement efforts for most relevant categories early to ensure accuracy for Scope 3 reporting that will be required from the second year of reporting.

- Develop robust internal capabilities, including enhancing data collection systems, upskilling staff in sustainability reporting, and integrating climate risk considerations into governance structures.

Notes:

[1] The Rating uses a 100-factor industry-specific model to generate a Carbon Performance Score. The resulting scores differentiate between leaders, performers, underperformers, and laggards on a scale from 0 (worst) to 100 (best): Climate Laggard (0-24); Climate Medium Performer (25-49); Climate Outperformer (50-74); Climate Leader (75-100).