DATE PUBLISHED: October 1, 2024

Climate Shareholder Proposals:

A More Sophisticated Discourse

A More Sophisticated Discourse

The debate on corporate climate action is becoming more nuanced as evidenced by recent trends in shareholder proposals.

Shareholder proposals offer a glimpse into investor and market sentiment on key corporate governance issues, including how companies are managing environmental and social impacts, risks, and opportunities. The topic of climate features prominently in shareholder proposal campaigns, as it remains a key priority for policymakers, investors, and corporate boards. ISS-Corporate analyzed shareholder proposals and voting results data from the past decade to discern key trends in voting patterns among investors as well as the underlying dynamics that may affect voting in relation to climate change-related engagements between companies and their shareholders. The analysis finds that climate-related shareholder proposals continue to rank high on the agenda of shareholder engagements , but these discussions are becoming more nuanced, as corporate disclosures and climate-related practices evolve and continue to improve. At the same time, investors appear to be taking a more targeted approach in dealing with these topics from a stewardship and voting perspective.

Recent Trends in Proposal Volumes and Voting

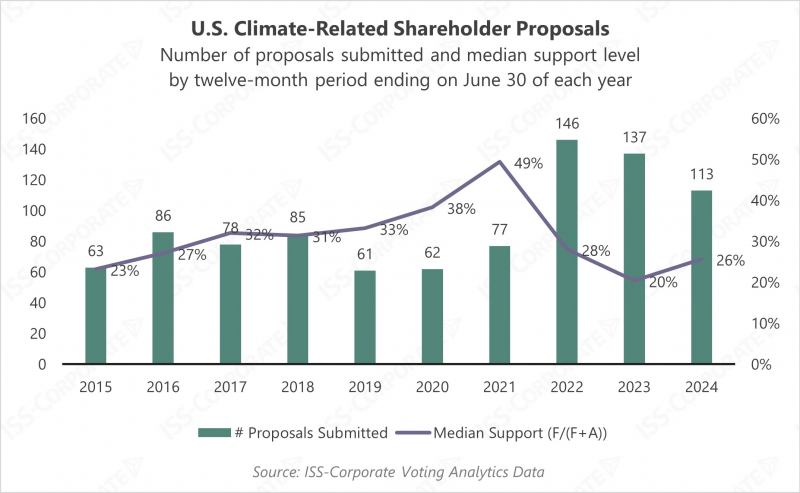

Shareholder proposals related to climate change in the United States increased in both volume and support levels in recent years, becoming some of the most prominent topics featured on annual general meeting ballots in the United States. In 2022 and 2023, however, support levels for these proposals dropped considerably from their 2021 peak, going from a median support of 49% of votes cast in 2021 to 20% in 2023. 2024 proxy season data shows a relatively high volume of submitted requests, at 113 proposals for the twelve-month period ending in June 2024. This is lower compared to the past two years, but still considerably higher than the rest of the past decade. Notably, support levels are edging upward compared to 2023, reaching a median level of 26% of votes cast.

Discerning Drivers behind Voting Trends

These trends reflect a confluence of factors, as the climate change corporate reporting landscape has significantly evolved over the past five years. Below are some key takeaways related to these changes.

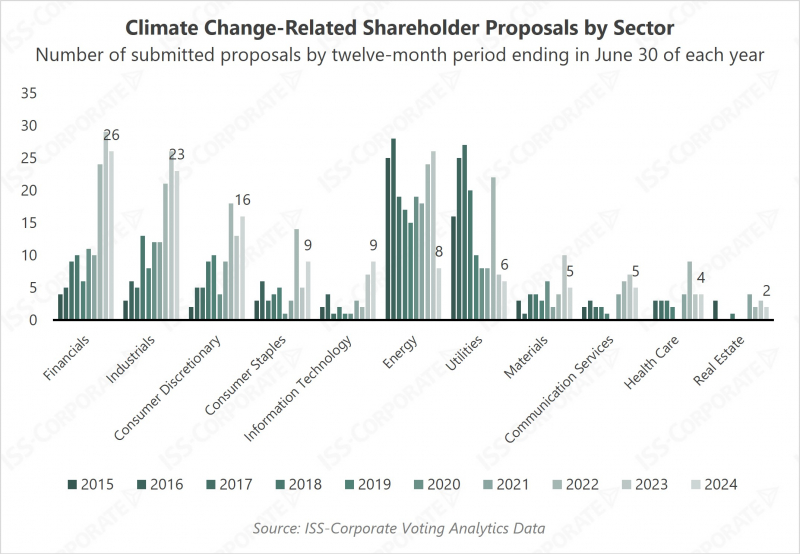

Shareholder proposals have shifted to focus primarily on commitments to net zero and alignment with the Paris Agreement, compared to earlier years where requests tended to focus on emissions disclosure. Decarbonization engagements are becoming more nuanced, as evidenced by a greater focus on Scope 3 emissions in recent proposals. This past proxy season, the Financials sector received the highest number of climate-related proposals in 2024. High-emitting sectors like Energy and Utilities, which had received the bulk of climate-related proposals in previous years, ranked low in terms of climate proposals volume.

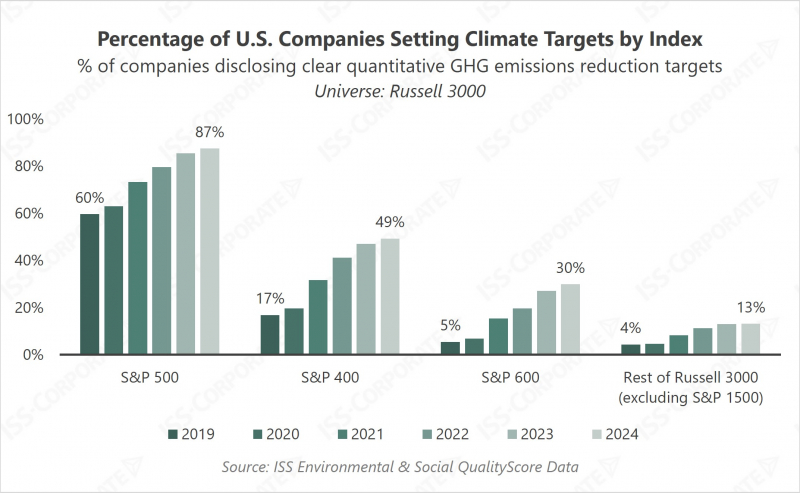

Companies are demonstrating more proactive efforts to manage climate risks, with a greater number of large U.S. firms improving their climate disclosures and setting GHG emissions reduction targets. According to ISS ESG Environmental & Social QualityScore data, as of July 31, 2024, 95% of S&P 500 companies disclose Scope 1 and Scope 2 emissions, and approximately 79% disclose their Scope 3 emissions. Further, more than 87% of the S&P 500 have established quantitative GHG emissions reduction targets. As the chart below indicates, quantitative GHG emissions reduction targets are becoming more common across companies of all sizes. Shareholder proposals typically target large-capitalization firms that likely have already introduced initiatives to address their climate risks and opportunities. While many of these initiatives may not always meet the expectations of proponents, the debate for further action becomes more sophisticated with these companies, and it may become more challenging for proponents to demonstrate significant gaps in companies’ strategies to rally broader support from other investors.

Investors’ perspectives and engagements on climate continue to evolve as more data, better disclosures, and new tools become available to help assess material risks and opportunities in the space. Recent departures from the Climate Action 100+ coalition may signal a scaling back of climate activism activities among large asset managers, likely due to increased pressure and scrutiny by key stakeholders in the United States. However, engagement strategies are likely becoming more targeted to better align with investor client interests, as indicated by recent announcements from BlackRock and State Street. As a significant segment of asset owners and retail investors continue to focus on decarbonization approaches, asset managers will likely adjust and potentially customize their engagements and voting approaches so that their stewardship efforts are tailored to the portfolio objectives of this segment of the market.