DATE PUBLISHED: January 21, 2025

Employee Turnover: A Key Metric for Human Capital Management

A Foundational Disclosure for Human Capital Management

Employee turnover is increasingly considered a key performance indicator of human capital management, with growing interest among internal and external stakeholders at corporations for reporting and managing against this metric. Historically, workforce metrics emphasized data linked to employee demographics or equal opportunity. In the United States, for example, the Equal Employment Opportunity Commission enforces the Equal Employment Opportunity law, which requires, among other stipulations, that employers with 100+ employees disclose an EEO-1 report detailing the demographics of their workforce.

In the European Union, the European Sustainability Reporting Standards (ESRS) require that workforce disclosures be taken a step further to include employee turnover. As many companies prepare to submit their first disclosures in accordance with ESRS in 2025, they may consider ESRS S1, which covers an entity’s own workforce, and which derives turnover from “the aggregate of the number of employees who leave voluntarily or due to dismissal, retirement, or death in service.”

Furthermore, investors may recognize risk in companies that have high employee turnover relative to their industry peers or compared to historical trends, as evidenced by the recommendations of the Human Capital Management Coalition (an investor group), which recommends employee turnover as one among the four human capital management foundational disclosures that companies can provide (the other three include data on number of employees, total cost of workforce, and diversity data). In 2023, the U.S. Securities Exchange Commission (SEC) released a Draft Recommendation on Human Capital Management Disclosures, which directly highlighted employee turnover (the likelihood of the SEC advancing a rulemaking in this area remains low).

With growing expectations on human capital management disclosures, companies stand to benefit by reporting employee turnover internally and externally and by actively managing against this key metric.

The Current Landscape of Corporate Disclosures on Employee Turnover

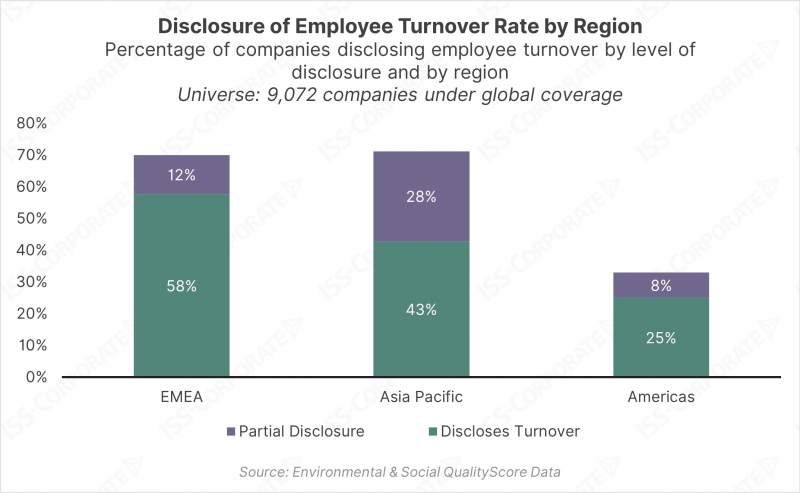

ISS-Corporate reviewed corporate disclosures in relation to employee turnover to identify major trends on how companies communicate this information to their key audiences. From a regional standpoint, disclosure levels in EMEA, Asia Pacific, and the Americas vary in terms of transparency. Among those that disclose employee turnover, some companies report data covering only a portion of their workforce, whereas others report the information comprehensively. With that said, EMEA and Asia Pacific are far ahead of the Americas, with approximately 70% of companies under review disclosing turnover for at least some of their employees, compared to just approximately 32% in the Americas.

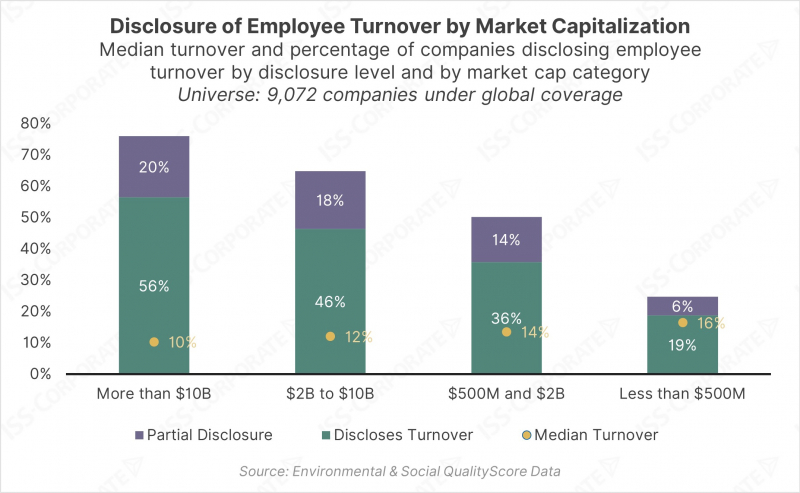

When analyzing data through the lens of market capitalization, one key trend stands out: as market capitalization increases, so does transparency and performance on employee retention. In other words, larger companies are more likely to disclose turnover, and their actual turnover rates are lower (less turnover; higher retention of employees) as compared to smaller companies.

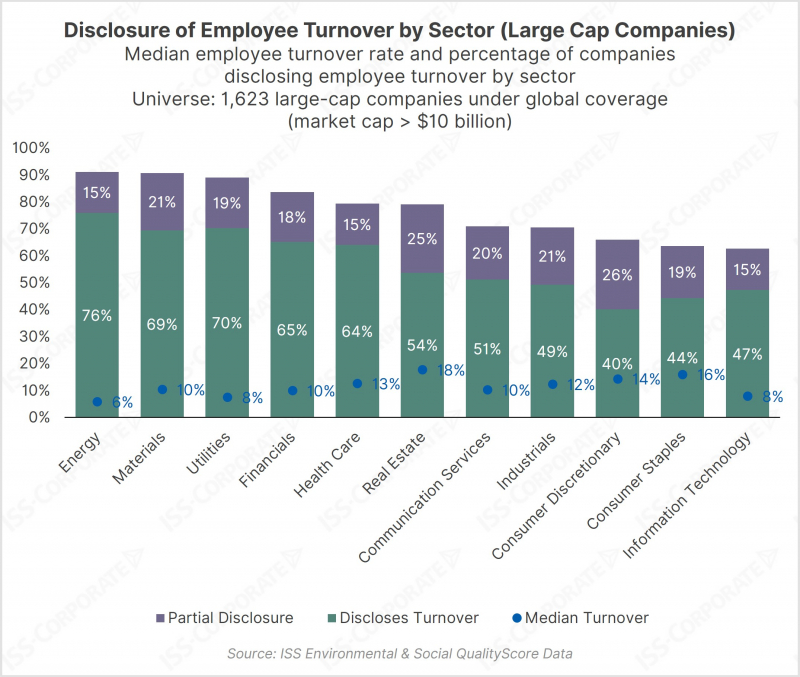

Employee turnover trends may be shaped by the specific dynamics of each industry. Workforce-dependent operations, skills specialization, and industry growth and innovation are all factors that can play a significant role in determining unique labor market conditions at the industry level. A sector-by-sector comparison of large cap companies demonstrates the variability by sector when it comes to employee turnover levels. However, the data also shows higher likelihood of employee turnover transparency for some sectors that tend to perform better with respect to employee retention. For example, the below graph shows how industries with the highest employee turnover disclosure rates – Energy, Materials, Utilities, and Financials – are among the strongest performers on employee retention. Similarly, some of the industries that lag in disclosure (e.g., Industrials, Consumer Discretionary, Consumer Staples) are among the weakest performers in employee retention. However, there are several outliers in the data, as the Real Estate sector experiences relatively high employee turnover rates with disclosure levels close to the median. In contrast, the Information Technology sector shows low employee turnover and the lowest level of disclosure compared to other sectors.

Human Capital Management Best Practices to Improve Employee Retention

The above observations on employee turnover disclosures and employee retention lead to valuable insights for companies in their efforts to improve their human capital management programs, which can have direct financial benefits, reducing operational costs and improving business continuity. Some key actions for companies seeking to improve their performance on employee retention may include:

- Establish employee turnover metrics as key performance indicators (KPIs) to track progress and incorporate accountability mechanisms to further facilitate focus on improvements.

- Engage employees leveraging tools, such as employee satisfaction assessments, to identify key improvement opportunities to inform human capital management strategy and action plan.

- Invest in career development and strategic training opportunities to foster employee growth and development. Developing robust employee performance assessments and skills inventories can serve as important components of a strong career development program.

- Embed cultural values at the heart of operations, cultivating a working environment that encourages collaboration, open communication, and collective problem solving.

- Assess the organization’s competitive position in the context of a holistic benefits and compensation program, including internal assessments of pay equity and fairness.