DATE PUBLISHED: May 31, 2024

Mandatory Climate Disclosure in South Korea

Mandatory sustainability disclosure has become a reality in South Korea, as the Korea Sustainability Standards Board (KSSB) published the Exposure Draft of the ‘Korean Sustainability Disclosure Standards’ on May 2. While the exact scope and timing of the initiative are yet to be unveiled, starting from 2026, climate-related disclosures will become mandatory.

In its announcement, the Financial Services Commission (FSC) made it clear that the agency is focused on finding the right balance between enhancing interoperability and avoiding excessive burdens. South Korea’s export-driven economy centers on large corporations with global footprints whose operations likely fall under the scope of new upcoming regulations across the world. Ensuring consistency with global disclosure standards therefore not only helps domestic firms to prepare themselves for upcoming requirements and maintain their competitiveness in the global capital market but also reduces duplicative reporting burdens. Against this backdrop, IFRS Sustainability Disclosure Standards serves as a basis for the new disclosure requirements in South Korea.

Considering the disclosure readiness in the country as well as its unique economic structure, the FSC decided not to follow suit with IFRS on some of the requirements, namely Scope 3 emissions.

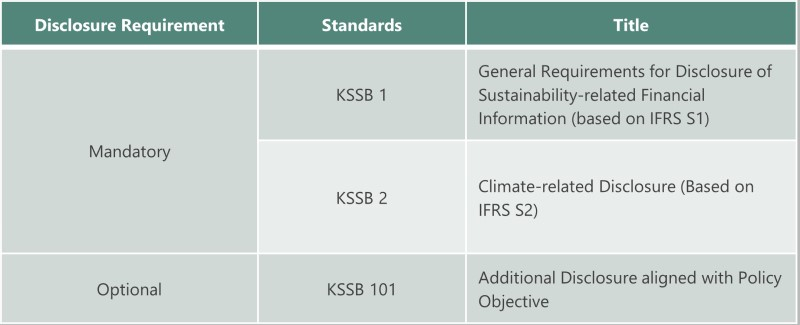

Structure of the Standards

The new requirements under the disclosure standards can be broken down into three main parts: general requirements (KSSB 1), climate-related requirements (KSSB 2), and voluntary disclosures (KSSB 101).

KSSB 1

Built on IFRS S1, KSSB 1 requires companies to disclose information about sustainability-related risks and opportunities that may have material impact on their prospects over a short-, medium-, and long-term time horizon. To comply with the requirements under KSSB 1, companies will need to align their disclosures with the four pillars of the TCFD recommendations: Governance; Strategy; Risk Management; and Targets and Metrics.

Under the overarching requirements of KSSB 1, companies are also required to provide information from the previous reporting period for all metrics disclosed in the current period, including qualitative or descriptive narratives, if relevant. Previously disclosed errors must be corrected and restated by the company unless it is impracticable to do so. In case there is uncertainty regarding data, or significant judgements were made while estimating measurements, companies must provide sufficient information that allows investors to make informed decisions. Lastly, companies are required to make an explicit and unreserved statement of compliance.

In addition to the general requirements and core contents, the standards are also underpinned by the following conceptual foundations: fair presentation, material information, reporting entity, and connected information.

While mandatory under IFRS S1, industry-based metrics will be optional under KSSB 1. IFRS S1 also requires companies to refer to SASB standards when identifying sustainability-related risks and opportunities and applicable disclosure requirements. This industry-specific approach under IFRS will be again only voluntary for South Korean companies.

Although companies may choose to disclose more, only climate-related disclosures will become mandatory. This climate-first approach not only reflects the urgency of addressing climate change but also is well in line with other developments in the global regulatory landscape.

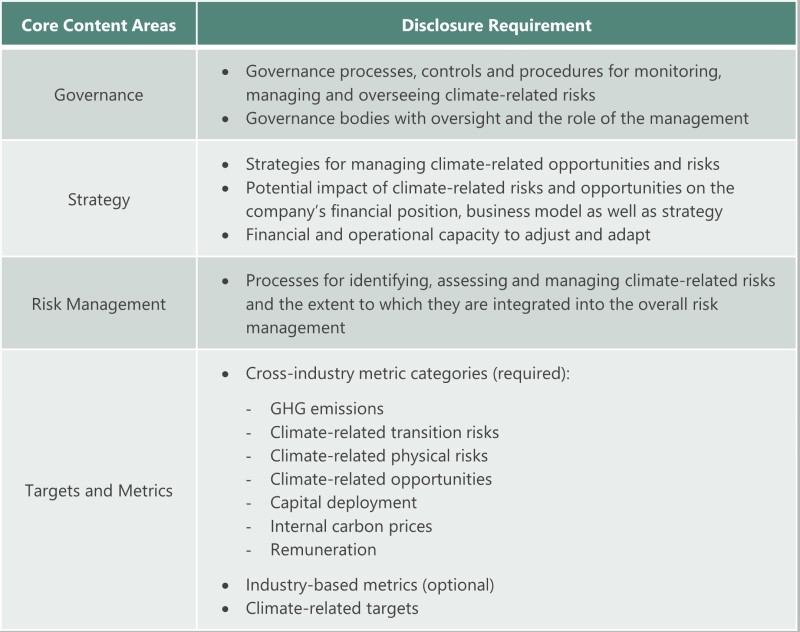

KSSB 2

Building on the general requirements set by KSSB 1, KSSB 2 prescribes how companies should disclose information about climate-related risks and opportunities, in line with the same four pillars of TCFD:

To comply with the requirements of KSSB 2, companies will need to measure and disclose their absolute gross Scope 1, 2, and 3 emissions in accordance with the GHG Protocol unless required otherwise by local jurisdictions. Whether and when to make Scope 3 disclosure mandatory has been the subject of considerable debate. The FSC stated that, while the agency acknowledges that Scope 3 emissions are crucial in assessing a company’s exposure to climate change, it also needs to consider the significant obstacles in measuring and reporting. The final decision will be made after reviewing feedback from various stakeholders and discussing internally with relevant government ministries.

In addition, KSSB 2 also requires companies to disclose whether and how they leverage internal carbon pricing to identify and manage climate-related risks and opportunities. Disclosure on the actual carbon price will not be mandatory and remain up to companies for now, as the methodology is still at an early stage.

KSSB 101

KSSB 101 serves as a country-specific set of standards, providing companies with guidance on disclosures beyond what is required under KSSB 2. The standard provides guidance on how to disclose sustainability-related information already required by laws or regulations (currently scattered across various domestic sustainability-related guidelines) and aligned with the country’s policy objectives. For example, low birth rate and an aging population have emerged as a national crisis in South Korea, and reversing the population decline is one of the government’s top policy priorities. In this instance, companies may refer to KSSB 101 and choose to provide information on their internal policies and procedures for promoting work-life balance or making childcare more affordable.

Overview of Disclosure Readiness

To assess disclosure readiness, ISS-Corporate examined the level of TCFD alignment among South Korean companies and compared to other markets in the region, including Taiwan, Japan, Singapore, and Hong Kong. As KSSB 2 is based on IFRS S2, the standard also fully incorporates the TCFD recommendations and a review of the level of alignment with the framework may serve as a good proxy for each market’s regulatory readiness.

South Korean companies will need to make significant enhancement to their disclosure before meeting the new requirements under KSSB 2. In terms of the overall alignment, currently about 8% of Korean companies do not meet the TCFD standards at all, and another 21% are only partially aligned.

Source: ISS-Corporate Climate Analytics

To better understand where the disclosure gap comes from, the charts below illustrate the level of alignment by market for each of the four TCFD pillars.

Source: ISS-Corporate Climate Analytics

Governance

The Governance pillar looks at whether the company discloses information about its governance processes, including controls and procedures for monitoring, managing, and overseeing climate-related risks and opportunities. This is the pillar where South Korean companies struggle the most to align their disclosures. About 30% of South Korean companies make no specific reference to the board oversight, and nearly a quarter of them do not discuss the role of management in assessing climate-related risks and opportunities. Other markets in the region also perform the worst on the governance pillar, possibly reflecting the common theme of low transparency in governance structures among Asian corporations.

Source: ISS E&S Raw Data, as of May 22, 2024

In addition, although it will be one of the cross-industry requirements under KSSB 2, only one South Korean company is currently disclosing information on whether and how they incorporate sustainability aspects into the variable component of executive compensation.

Strategy

As implied by its name, the Strategy pillar evaluates how companies communicate their climate change strategies. Roughly three quarters of the companies in this market provide comprehensive or quantifiable information about their climate change strategies and related opportunities.

Source: ISS E&S Raw Data, as of May 22, 2024

While KSSB 2 does not impose any specific rules, the standard does require companies to conduct scenario analysis and provide details on each climate scenario. Nonetheless, nearly half of the companies do not make any reference to multiple climate change scenarios in their climate-related disclosures.

Risk Management

The Risk Management pillar requires the company to provide information on its procedures and internal controls for managing climate-related risks and how they are integrated into the overall risk management process. South Korean companies are better aligned with this pillar compared to other ones, with almost half of them exemplifying the standard.

Source: ISS E&S Raw Data, as of May 22, 2024

Emissions reporting is among the areas where the level of readiness is the highest with a vast majority of South Korean companies having had their emissions data verified by an independent third-party, thus demonstrating better management of risks related to disclosure accuracy and validity of information.

Targets and Metrics

To align with the TCFD framework on the Targets and Metrics pillar, companies are required to disclose metrics on climate-related risks and opportunities, quantifiable and time-bound targets, as well as progress made over time. South Korean companies have taken initial steps and made some progress in emissions reporting, with nearly 90% of them disclosing their Scope 1 and 2 emissions. However, when it comes to Scope 3 emissions, more than 35% do not disclose any data, suggesting that companies are still coping with the challenges associated with measuring emissions across the value chain.

Target setting poses another major challenge. While more than 80% of South Korean companies have quantitative emissions reduction targets already in place, only about 1% of the targets are currently consistent with limiting global temperature rise to 1.5°C, indicating the lack of a credible decarbonization roadmap aligned with the Paris Agreement.

Source: ISS E&S Raw Data, as of May 22, 2024

Next Steps: Beyond TCFD

Mandatory climate disclosure is imminent in South Korea. The relatively low level of alignment with the TCFD may suggest that the market has some way to go to meet the new standards. Even companies that already report in full alignment with the TCFD recommendations will not necessarily meet the new disclosure requirements. There remains a significant gap between the mandatory disclosure under IFRS S2 and the TCFD recommendation. According to a recent analysis conducted by ISS-Corporate, the scope and granularity of the mandatory disclosures under IFRS S2 are far greater compared to the TCFD recommendations, and even best-in-class TCFD-aligned disclosures may not fulfill more than half of IFRS S2 cross-industry disclosure requirements. Since KSSB 2 is built on IFRS S2, complying with the standard will also likely require companies to make significant enhancements in their climate-related disclosures.

Meeting disclosure requirements is just a starting point on a company’s climate journey and taking meaningful actions and demonstrating progress over time are increasingly becoming the main considerations among key audiences. To manage the expectations of various external stakeholders, companies can benefit from incorporating climate action in their disclosures following the new standards.