DATE PUBLISHED: May 22, 2024

Pro-ESG Shareholder Proposals Regaining Momentum in 2024

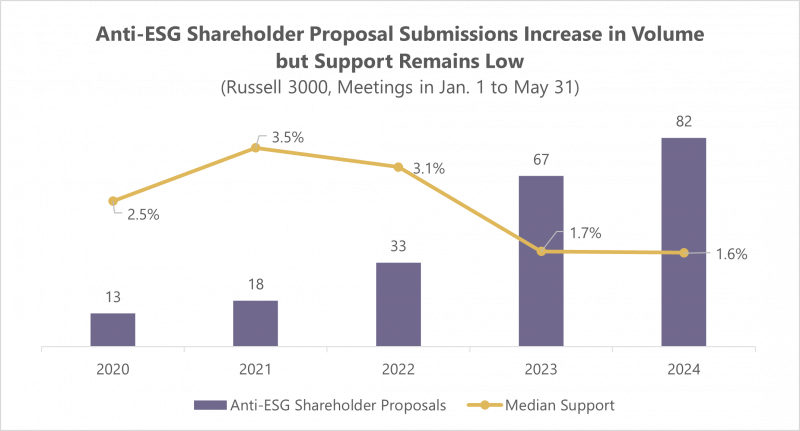

Governance is back on focus this proxy season, with both the volume and support on proposals aiming to enhance shareholder rights and companies’ governance practices gaining steam. Environmental and social proposals are showing a sign of reversing trend of declining support from the 2021 peak, while anti-ESG proposals are gaining volume but not support.

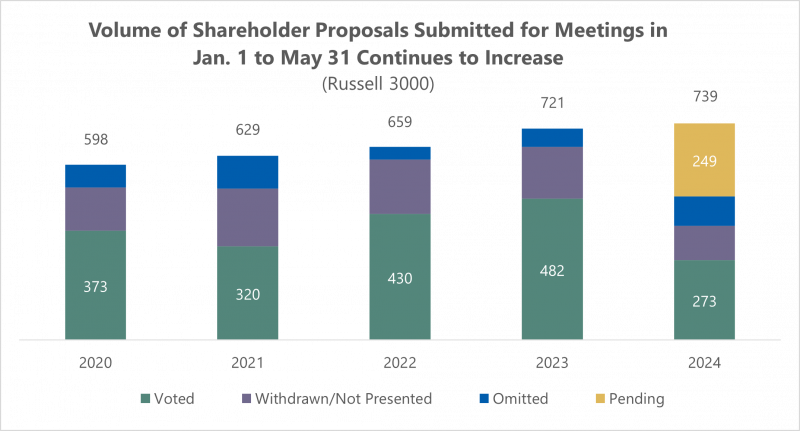

We reviewed proposals submitted for Russell 3000 company AGMs held between Jan. 1 and May 31 for each year since 2020 to shed light on how investors were bringing up their concerns ahead of the May 23 peak U.S. AGM date, which topics carry the greatest currency, and their level of success.

Key Takeaways:

- The volume of shareholder proposals submitted for annual meetings held between Jan. 1 through May 31 increased to 739 proposals with 273 voted thus far and 249 still pending.

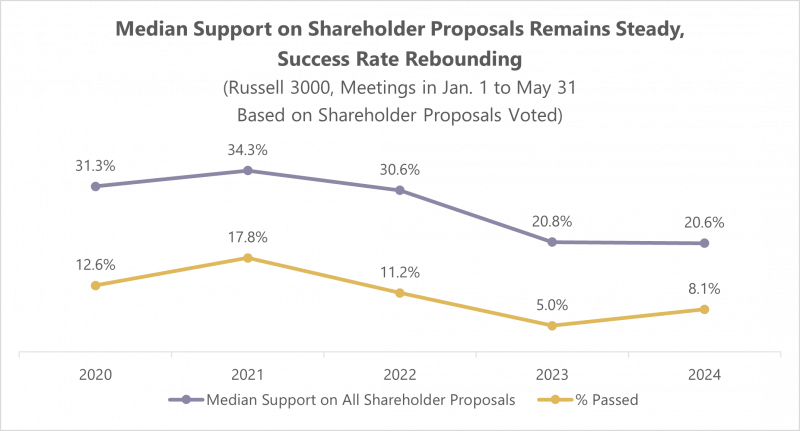

- The median support level of all shareholder proposal is largely unchanged at 20.6% for 2024, but those receiving majority support is ticking up.

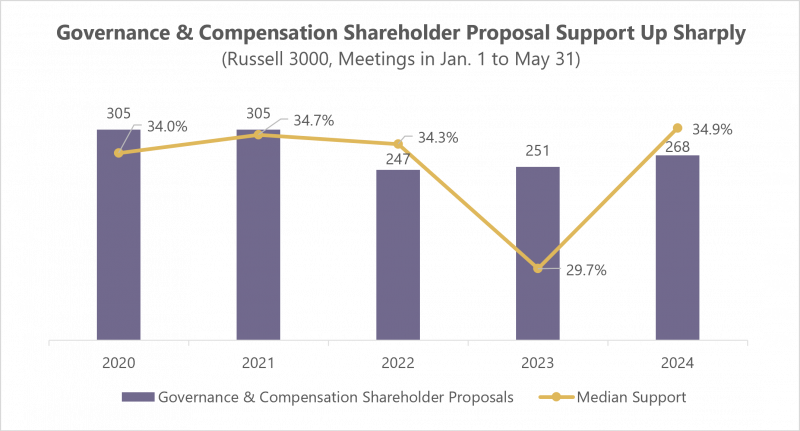

- Governance and compensation proposals are regaining focus and interest from investors, with 268 such proposals submitted for the first five months of 2024. The median support surged to 34.9%, a level unseen in the past five years.

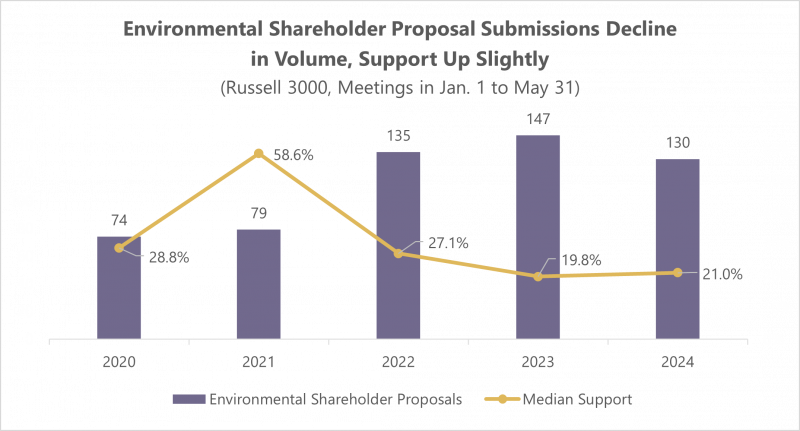

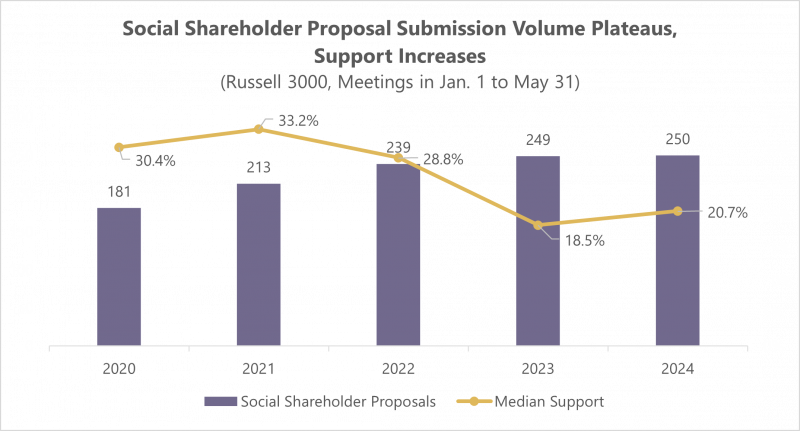

- The volume of environmental proposals decreased to 130 proposals and social proposal volume remained mostly flat. However, support on both environmental and social proposals are up slightly, reversing the two-year consecutive decline in support since 2021.

- Anti-ESG proposals continue to increase in number, but the support remains low.

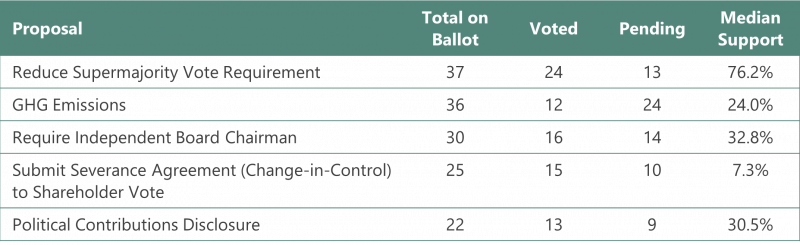

- Top 5 most prevalent proposals on ballot represent a broad range of topics, including shareholder rights, board accountability, executive pay, GHG emissions, and political spending.

Total Proposals Rose, Support Flat, but Success Rebounding

Based on submissions since 2020, the number of proposals among Russell 3000 companies continued to increase, rising to 739[1] for meetings scheduled between January and May. The number of shareholder proposals steadily increased between 2020 and 2024YTD, with the total rising by almost a quarter. 273 proposals have been voted thus far in 2024, with 249 still pending for the remainder of May.

Source: ISS-Corporate, Voting Analytics

While the volume of shareholder proposals submitted increased steadily since 2020, the support eroded, especially from the record high support in 2021. Median support on shareholder proposals voted during the first five months of 2024 stood at 20.6%, decreasing slightly from 20.8% in 2023. However, some proposals are gaining strong support, with 8.1% of those voted in 2024 receiving majority support. Although the success rate is less than one-half of the level seen in 2021, it is showing signs of a rebound.

Source: ISS-Corporate, Voting Analytics

Reversal of Declining Support on ESG, Led by Governance and Compensation Proposals

An uptick in volume of governance and compensation-related shareholder proposals as well as anti-ESG proposals challenging implementation of climate or social initiatives is fueling the increase in shareholder proposal submissions in 2024, while environmental or social proposals are remaining largely flat or are declining in number. Governance and compensation proposals submitted increased by 17 to 268 proposals, and anti-ESG proposals increased by 15 to 82 proposals in the first five months of 2024. This season, governance in particular is gaining renewed interest and focus, with not only the volume increasing but the support level increasing sharply to 34.9%, a level unseen in the past five years. Anti-ESG proposals, on the other hand, are not experiencing success at the ballot box despite the continued surge in volume, with the median support level of 1.6% so far in 2024.

Source: ISS-Corporate, Voting Analytics

Source: ISS-Corporate, Voting Analytics

Environmental proposals dropped in number to 130 from 147 proposals submitted for shareholder meetings in the first five months of the year, and the volume of social proposals was almost unchanged at 250. The support level, however, is up slightly for both environmental and social proposals, reversing the trend of declining support since 2021.

Source: ISS-Corporate, Voting Analytics

Source: ISS-Corporate, Voting Analytics

Broad Range of Topics on the Ballot in 2024

The top five most prevalent proposals on ballot this year reveals a broad range of topics shareholders are focused on. These proposals include those aiming to enhance shareholder rights, to reduce GHG emissions, to increase board independence and oversight, to require greater shareholder input on severance payments, and to enhance transparency on political spending. The most prevalent—and also the most successful—proposal is to reduce supermajority vote requirement to amend the company’s governing documents. These proposals often are viewed as enhancing shareholder rights by reducing the bar for effecting change at the company. 37 proposals have appeared on ballot during the first five months of 2025, with 24 voted and 13 pending, garnering eye-popping median support of 76.2%.

Top 5 Most Common Proposals on Ballot in 2024[2]