DATE PUBLISHED: September 19, 2024

Tax Transparency: A Key Element of Sustainability Reporting

The Role of Taxation in Corporate Sustainability

Taxation plays a vital role in achieving the UN Sustainable Development Goals (SDGs),[1] and serves as a key mechanism through which organizations contribute to society, public services, economic development, and social welfare in the countries that they operate in.

However, it is estimated that $240 billion are lost annually due to tax avoidance by multinational corporations.[2] Some multinational corporations are accused of exploiting gaps and mismatches in tax rules to artificially shift profits to low or no-tax locations where there is little or no economic activity or to erode tax bases through deductible payments such as interest or royalties (Base Erosion and Profit Shifting; BEPS).

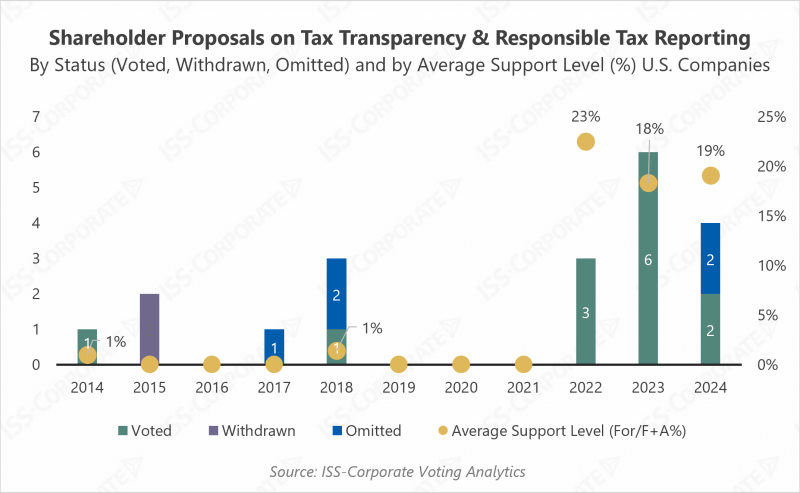

Corporates are increasingly under pressure to demonstrate how their tax strategy and practices align with their stated sustainability visions and strategies. Over the years, several large U.S. companies have received shareholder proposals requesting for greater tax transparency, and we continue to see these types of proposals in 2024, signaling that the topic remains of interest to shareholders and other stakeholders.

Regulations and Standards on Tax Transparency

In response to the growing demand for greater tax-related transparency, related reporting standards and frameworks have emerged, including guidance from sustainability reporting initiatives.

In the GRI 207: Tax 2019 standard[3], the Global Reporting Initiative (GRI) outlines reporting guidelines for public, country-by-country reporting on tax, alongside tax strategy and governance.

[1] GRI Standard can be downloaded from: https://www.globalreporting.org/search/?query=GRI+207

Key components of GRI 207: Tax 2019

The Standard contains three management approach disclosures and one topic-specific disclosure on country-by-country reporting. The combination of management approach disclosures and country-by-country reporting gives insight into an organization’s tax practices in different jurisdictions.

Management approach disclosures require a narrative explanation of how organizations manage tax.

- Disclosure 207-1 Approach to tax

- Disclosure 207-2 Tax governance, control and risk management

- Disclosure 207-3 Stakeholder engagement and management concerns related to tax

Country-by-country reporting requires reporting of financial, economic, and tax-related information for each jurisdiction in which the organization operates.

- Disclosure 207-4 Country-by-country reporting

In the EU, the Public Country-by-Country Reporting Directive requires multinational companies located in the EU or with operations in the EU, with total consolidated revenue equal to or higher than €750 million, to file the country-by-country report publicly. Under this Directive, companies will be required to report on tax information for the financial year starting in or after June 2024 at the latest.

As it relates to the Corporate Sustainability Reporting Directive (CSRD), a specific European Sustainability Reporting Standards (ESRS) standard has not been developed on the tax transparency, but since the CSRD is based on the principle of double materiality, companies that consider the topic of tax to be material will be required to report on this topic. For these entity-specific disclosures, ESRS allows for the use of reporting standards such as the GRI.

Which companies are already disclosing tax information publicly?

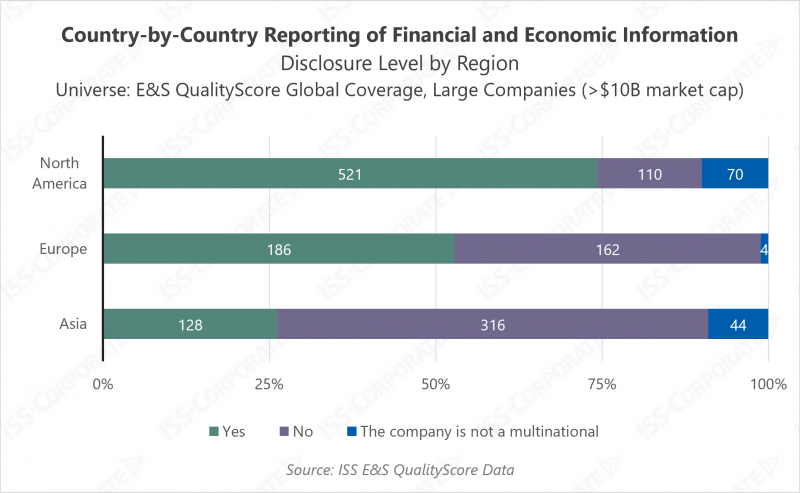

Approximately 74% of large companies in North America already provide country-by-country reporting of financial and economic information, whereas 53% of European companies and 26% of Asian companies do so. Disclosure by European companies are expected to increase after the public CbCR becomes a requirement in all EU member states for large multinational companies.

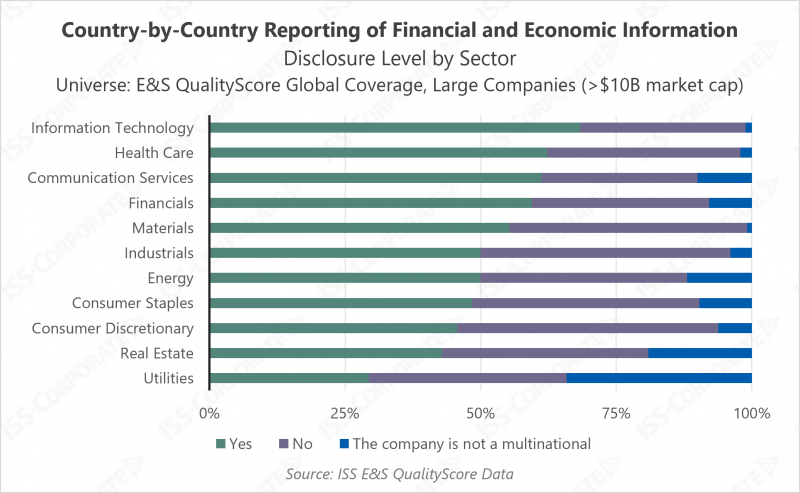

Disclosure varies by sector. The Information Technology sector provides the greatest transparency on this topic across all regions (68% of companies under review), whereas the utilities sector demonstrates a lower rate of disclosure in this area (29% of companies under review). The lower level of disclosure among utilities firms can be explained by the fact that there are fewer multinational companies in this sector.

Tax Information Will Be a Key Element in Future Sustainability Reporting

Tax transparency has not been a focal point in corporate sustainability discourses, despite the critical role that taxation plays in the social and economic impact to the countries that companies operate in. Today, a growing number of companies are integrating the SDGs into their business strategy and the core of their activities. These new commitments require more attention to how tax strategy and relevant practices align with sustainability strategies and objectives.

Notes:

[1] See Tax for SDG Initiative (https://www.taxforsdgs.org/); Taxation of SDGs (https://financing.desa.un.org/what-we-do/ECOSOC/tax-committee/thematic-areas/taxation-and-sdgs)

[2] OECD Inclusive Framework on Base Erosion and Profit Sharing (https://www.oecd.org/tax/beps/about/)

[3] GRI Standard can be downloaded from: https://www.globalreporting.org/search/?query=GRI+207